Lump Sum

From $5,000 - $5,000,000

Repayment Term

8-25 Year Terms

Predictable

Fixed Monthly Payments

Who Qualifies

Minimum Requirements for SBA 7(a) Loans

with Huge Capital Funding

650+ Credit Score

$250k+ Annual Revenue

2 Years Time in Business

Up to Date on Taxes

*Meeting Minimum Requirements Does Not Guarantee Approval. Several factors are considered in underwriting decisions, including, but not limited to the requirements listed above.

**Stronger profiles typically have 1 year time in business, established banking relationships, 720+ credit score, 15% or less credit utilization, access to $15k+ personal credit limits, less than 6 hard inquiries and often qualify for larger approvals.

What Is an SBA Loan?

An SBA loan is a government-backed business loan designed to help small businesses access affordable, long-term funding.

The most popular program — the SBA 7(a) — offers low interest rates, high approval potential, and repayment terms up to 25 years.

At Huge Capital, we guide you through the SBA process step-by-step, helping you avoid delays and making sure your file is submitted right the first time.

Whether you’re expanding, buying a business, refinancing debt, or opening your first location — we’ll help you secure the right SBA funding without the usual headaches.

Benefits of an SBA Loan with Huge Capital Funding

Lower Cost of Capital

SBA 7(a) loans offer competitive interest rates and long repayment terms.

Use for Almost Any Purpose

Real Estate, Working Capital, Inventory, Equipment and Debt Refinance.

Backed by The U.S. Government

Banks are more willing to approve when the SBA guarantees part of the loan

See If SBA Financing Is Right For You

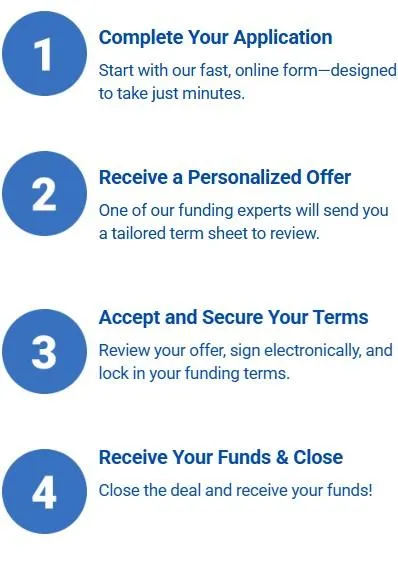

Get a DSCR Loan In 4 Simple Steps

with Huge Capital Funding

Get an SBA Loan In 3 Simple Steps

with Huge Capital Funding

Get Pre-Qualifed

Tell us a bit about your business and funding goals - no hard credit pull.

Get Expert Guidance

We review your file and walk you through the SBA checklist with real advice.

Get Funded

We match you with the right bank and guide the process through approval, closing and funding.

Get an SBA Loan In 3 Simple Steps

with Huge Capital Funding

Get Pre-Qualifed

Tell us about a bit about your business and funding goals - no hard credit pulls

Get Expert Guidance

We review your file and walk you through the SBA checklist with real advice.

Get Funded

We match you with the right bank and guide the process through approval, closing and funding.

Minimum Qualifications for an SBA 7(a) Loan..

$100K

Annual Business Revenue

Business

Checking Account

600

Personal Credit Score

6 Month

Time In Business

Lump Sum

From $5k-$1mm

Repayment Term

6-84 Month Terms

Predictable

Daily, Weekly Or Monthly Payments

Are We a Match? Here’s What Most Qualified

SBA 7(a) Loan Applicants Look Like:

Business

Financials Are in Order

$250K

Annual Business Revenue

2 Years

Time In Business

650+

Personal Credit Score

FAQ's

How Much Can I Qualify For?

SBA 7(a) loans range from $30,000 to $5 million. Your funding amount depends on your use of funds, cash flow, and business profile.

Will This Affect My Credit?

We start with a soft pull — no impact to your score. A hard pull happens only if you move forward with a lender after they have proposed a term sheet and pre-underwritten your loan

What Are SBA Loan Rates?

SBA loan rates are typically based on the Prime Rate plus a lender spread — most fall between 9–11% APR as of 2025. However, we work with banks that can offer subprime rates, meaning you may qualify for rates even lower than average, depending on the strength of your financials.

We’ll structure your file to help you access the most competitive terms available — not just what the first lender offers.

Why Should I work With Huge Capital?

Because SBA loans are hard — we make them easy. Instead of chasing 5 different banks and sending 20 emails with your financials, you get one expert team that does the work for you and actually explains things along the way and puts you in touch with the right lender off the jump.

“You don’t need to know everything about funding — you just need someone who does, and who actually gives a damn about your outcome.”

Offers presented by Huge Capital are conditional and subject to third-party lender approval. Final terms depend on underwriting criteria, creditworthiness, business financials, and lender-specific requirements. Same-day or expedited funding is not guaranteed and may vary by lender, product, and time of application.

Huge Capital is not always a direct lender. We may broker financing through a vetted network of funding partners. Some underwriting decisions are made by third-party institutions, and offers are extended based on lender terms. Clients have the option to accept or decline any offer received.

Huge Capital does not perform hard credit inquiries for prequalification. However, some lenders in our network may require full documentation or credit verification before final approval. Loan terms and conditions, including interest rates and repayment schedules, vary by lender and applicant profile.

Not all industries or business types are eligible for funding. Certain restrictions may apply based on lender guidelines and state laws.

Huge Capital makes no guarantees of approval or specific funding amounts. The total capital available depends on business credit, revenue, existing liabilities, and the lender's risk assessment.

Loans and funding products are subject to change without notice. Huge Capital is located at 930 S 4th St, STE 209, Las Vegas, NV 89101.