Up to 30 Year Terms

Maximum Repayment Term

Up to 85% LTV

Available to Qualified Borrowers

$75k-$100M

Loan Amount Available

Who Qualifies

Minimum Requirements for DSCR Loans

with Huge Capital Funding

660+ Credit Score

NOT a First-time Home buyer

20% of Purchase Price Liquid

*Meeting Minimum Requirements Does Not Guarantee Approval. Several factors are considered in underwriting decisions, including, but not limited to the requirements listed above.

*Stronger profiles typically have 700+ credit, 30-50% of the purchase price liquid, have owned 2+ homes along multiple investment properties. These borrowers get the lowest rates, less closing costs and require less money down.

What is a DSCR Loan?

A DSCR (Debt Service Coverage Ratio) loan is a type of real estate financing designed specifically for investors purchasing or refinancing income-producing properties—primarily rentals.

Rather than focusing on your personal income, these loans are underwritten based on the property’s ability to generate enough rental income to cover its debt obligations. This makes DSCR loans especially attractive to investors looking to grow their portfolio without traditional income verification hurdles.

DSCR loans are most commonly used by real estate investors seeking to scale quickly and efficiently. Since qualification is based on rental cash flow, not W-2s or tax returns, these loans are ideal for self-employed borrowers, full-time investors, or anyone aiming to keep their personal finances separate from their investment activity.

Whether you’re acquiring a new property, refinancing a current one, or cashing out equity to reinvest—DSCR loans offer a flexible, streamlined path to long-term growth.

Benefits of a DSCR Loan with Huge Capital Funding

No Income Verification

Loan qualification is based off the property’s cash flow rather than your income.

Business, Not Personal

Keep your personal name off public records and enjoy asset protection for your portfolio.

Close in 3-5 Weeks

With Huge Capital, DSCR loans close in 21–35 days, keeping your investment timeline on track.

Plan Your Next Investment

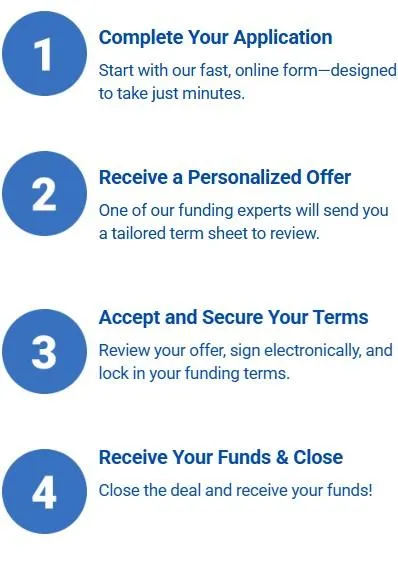

Get a DSCR Loan In 4 Simple Steps

with Huge Capital Funding

Get a DSCR Loan In 3 Simple Steps

with Huge Capital Funding

Complete Your Application

Start with our fast, online form—designed to take just minutes.

Receive a Personalized Offer

One of our funding experts will send you a tailored term sheet to review.

Receive Your Funds & Close

Review your offer, sign electronically, and receive your funds!

Are We a Match? Here’s What We Need.

Funding Amount

$75,000

Credit Score

660+ FICO

Experience

Cannot be 1st Time Home Buyer

Down Payment

As low as 10%

Lump Sum

From $5k-$1mm

Repayment Term

6-84 Month Terms

Predictable

Daily, Weekly Or Monthly Payments

Are We a Match? Here’s What Most Qualified

DSCR Applicants Look Like:

Credit Score

660+ FICO

Loan Amount

$75,000

Down Payment

As low as 10%

Experience

Cannot be 1st Time Home Buyer

DSCR Loans vs. Mortgages

DSCR (Debt Service Coverage Ratio) loans are designed for real estate investors who want to qualify based on the income potential of the property—not their personal financials. These loans don’t require W-2s, pay stubs, or personal income verification, making them faster and easier to close. As long as the property's rental income can cover the loan payments, you’re in a strong position to qualify. This approach streamlines the process, ideal for scaling your portfolio. Investors benefit from flexibility, speed, and less red tape.

Traditional mortgages are underwritten based on your personal income, employment history, and debt-to-income (DTI) ratio. This makes the process slower and more document-heavy, often requiring tax returns, bank statements, and credit checks. Even if a property is cash-flowing, a borrower with high personal debt or inconsistent income could be denied. These loans are better suited for primary residences, not investment properties. For seasoned investors, this can limit growth and slow down acquisitions.

FAQ's

What is a DSCR Loan?

A DSCR loan is a real estate investment loan that qualifies the borrower based on the property’s income, not the borrower’s personal income or employment status.

What are the loan terms?

Most DSCR loans offer 30-year fixed, 30-year interest-only, or adjustable-rate mortgage (ARM) options. 30-year fixed is the most commonly used term among investors.

Can I refinance into a DSCR Loan from another loan?

Yes. Investors commonly use DSCR loans to cash out equity or refinance from hard money or short-term loans (like fix and flip loans).

How much can I borrow?

Lenders typically fund 80-85% of the purchase price or appraised value for purchases or rate and term refinances, and up to 75% LTV for cash-out refinances.

How is DSCR Calculated?

DSCR = Net Operating Income ÷ Total Loan Payment.

If a property brings in $2,000/month and the mortgage is $1,500/month, the DSCR is 1.33. A ratio above 1.0 means the property covers its own expenses.

“You don’t need to know everything about funding — you just need someone who does, and who actually gives a damn about your outcome.”

Offers presented by Huge Capital are conditional and subject to third-party lender approval. Final terms depend on underwriting criteria, creditworthiness, business financials, and lender-specific requirements. Same-day or expedited funding is not guaranteed and may vary by lender, product, and time of application.

Huge Capital is not always a direct lender. We may broker financing through a vetted network of funding partners. Some underwriting decisions are made by third-party institutions, and offers are extended based on lender terms. Clients have the option to accept or decline any offer received.

Huge Capital does not perform hard credit inquiries for prequalification. However, some lenders in our network may require full documentation or credit verification before final approval. Loan terms and conditions, including interest rates and repayment schedules, vary by lender and applicant profile.

Not all industries or business types are eligible for funding. Certain restrictions may apply based on lender guidelines and state laws.

Huge Capital makes no guarantees of approval or specific funding amounts. The total capital available depends on business credit, revenue, existing liabilities, and the lender's risk assessment.

Loans and funding products are subject to change without notice. Huge Capital is located at 930 S 4th St, STE 209, Las Vegas, NV 89101.